Meridian Membership

Your affordable healthcare solution.

How it Works

Individuals, couples, and families contribute financially to the members’ escrow account and we administrate sharing from the account.

All members must agree to our Statement of Standards.

What’s Included

Discover the health care services and discounts that you receive with a Meridian Membership.

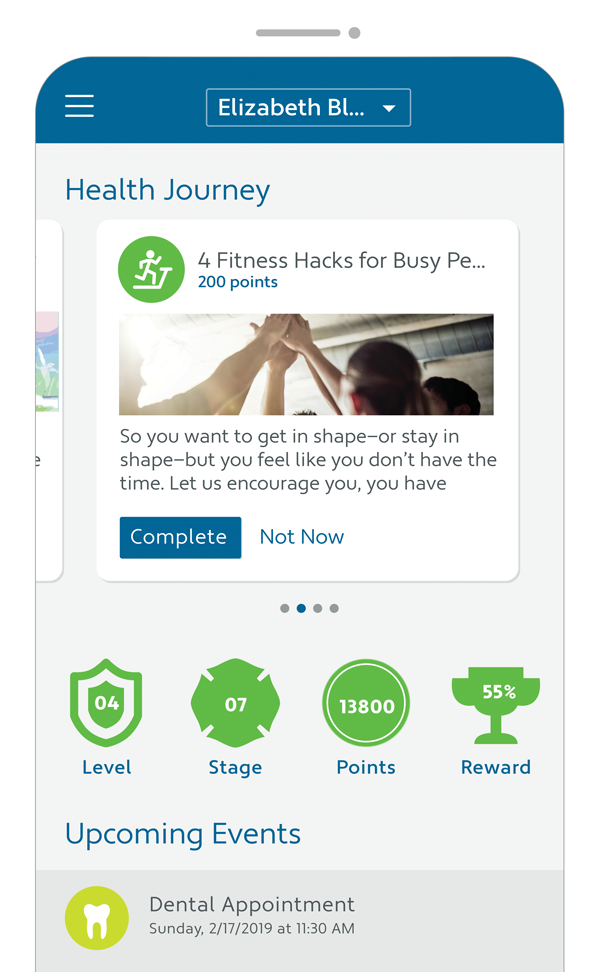

Mobile App

Use the Altrua HealthShare App to easily view your health information, submit medical needs, see your contribution amount, and access all of our services.

Membership Guidelines

Members’ medical needs are shared according to the Membership Guidelines and escrow instructions.

The Beliefs Our Members Share

Our members agree to live a clean and healthy lifestyle and share a set of ethical and religious beliefs. It means that our members can contribute less and receive more from the membership.

Statement of Standards

- We care for one another.

- We keep our bodies clean and healthy with proper nutrition.

- We believe the use of any form of tobacco, illicit drugs and excessive alcohol consumption is harmful to the body and soul.

- We believe sexual relations outside the bond of marriage are contrary to the teachings of the Bible and that marriage should be held in honor.

- We believe abortion is wrong, except in a life-threatening situation to the mother.

- We care for our families and physical, mental or emotional abuse of any kind to a family member or anyone else is morally wrong.

Included with a Meridian Membership

Unlimited Office/Urgent Care Visits

Members receive unlimited office, specialist and urgent care visits. Once the Office Visit MRA is met, the Membership will share up to $300 per eligible visit towards the 1st then 2nd MRA, on the Member’s behalf.

Counseling

Because the Membership is made up of people that care for one another, we are pleased to provide counseling services that members can share with everyone in their family—even those not on the membership!

Telemedicine

Members have access to licensed physicians and healthcare providers 24 hours a day, 7 days a week through telemedicine, all from the comfort and convenience of their home, workplace, or while traveling.

LASIK

Savings of 40%–50% off the overall national average cost for traditional LASIK surgery. WA customers will save 15% off standard prices or 5% off promotional prices

PRESCRIPTION SAVINGS

15%–60% off the retail price of generic drugs and 10%–25% off the retail price of brand name drugs.

Vision

Save 5–40%.

Maternity

Max Sharing Limit

Year 1: $12,000

Year 2+: $25,000

Alternative Health

Save 25% on services from specialty health care providers. Not available in WA.

Diabetes

20%–40% off the retail price of Disposable Medical Supplies, Nutritional Supplements and Daily Living Aids

Cancer Treatment

Subject to annual and lifetime max.

Biennial screening requirements for females 40 and over and males 50 and over.

Hearing

Savings of 30%–60% on hearing aids. WA customers will save 15% off standard prices or 5% off promotional prices.

Member Financial Responsibility

Member Responsibility Amounts (MRAs)

Members are responsible for a financial portion of eligible medical needs.

1st MRA

The 1st MRA is the yearly amount paid to a licensed medical professional/facility that must be met before the 2nd MRA applies.

| 1ST MRA OPTIONS | |

|---|---|

| $1,000 | $2,500 |

A 1st MRA option of $1,000 or $2,500 per person per calendar year is selected during the enrollment process.

2nd MRA

The amount you are responsible to pay to a licensed medical professional/facility after the 1st MRA is met. The Member shares 20% and the Membership shares 80% of the next $25,000 in eligible medical needs. The Membership shares simultaneously in your eligible medical needs as your 2nd MRA is being met. Each Member is responsible for a maximum of $5,000 to the licensed medical professional/facility.

Office Visit/Urgent Care MRA

Members submit a $25 MRA for primary/urgent care visits and a $45 MRA for specialist visits.

Emergency Room MRA

The member is responsible for $200 for an emergency room visit for eligible medical needs.

Monthly Membership Contributions

The Head of Household/Primary Member is sent monthly contribution requests based on age and/or number of household members, which they submit to stay active in the Membership. Contribution amounts are determined by the 1st MRA Option and Lifetime Sharing Limit Option the Member selects during the enrollment process.

For households that exceed 5 members, an additional monthly contribution of $50 is required for each additional dependent.

Membership Limitations

Lifetime Sharing Limits

The Lifetime Sharing Limit is the maximum amount shared for eligible medical needs over your lifetime of membership.

| LIFETIME SHARING LIMIT OPTIONS | |||

|---|---|---|---|

| $50,000 | $100,000 | $500,000 | $1,000,000 |

This limit applies to all Medical Need Sharing provided under the Membership. The Membership will not share in any medical needs that exceed the designated Lifetime Sharing Limits selected by the Member during the enrollment process.

Waiting Period

Medical needs are ineligible until 90 days after your membership effective date.

- The 90 day waiting period does not apply to emergency procedures or required cancer screenings.

- COVID-19 Testing and Vaccinations have a 30 day waiting period from the membership effective date before these medical needs become eligible.

Membership Guidelines

- Understand your responsibilities as a Member

- Know what medical needs are shared by the membership

- See how the Membership operates